Exceptional Customer Service

Vailshire Capital Management, LLC is pleased to offer professional, courteous, and highly personalized investment services for individuals, joint accounts, families, family offices, endowments, and funds of funds.

Innovative Investment Techniques

Vailshire seeks to grow and protect its clients’ portfolios via innovative investment techniques and risk-reduction strategies.

Both the flagship hedge fund (Vailshire Partners, LP) and separately managed accounts (SMAs) seek to produce satisfactory long-term investment returns by acquiring a diversified core of under-appreciated holdings across multiple uncorrelated asset classes and using a full-cycle investment approach.

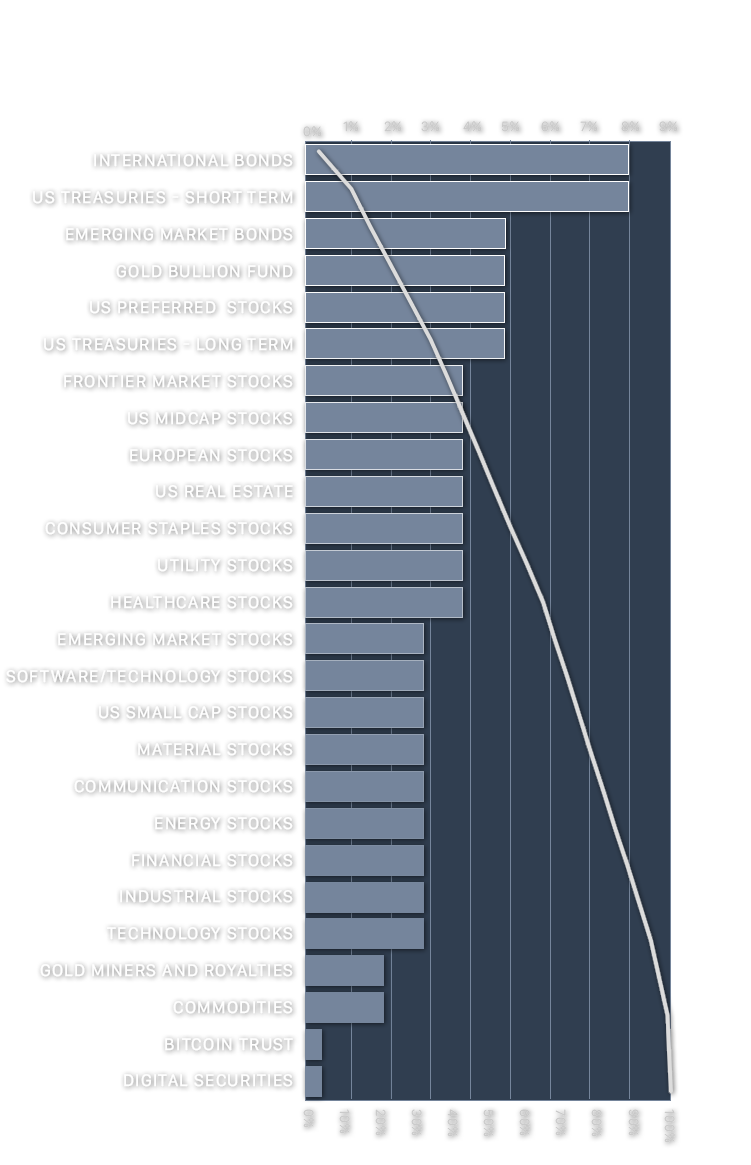

Given Dr. Ross’s areas of expertise, Vailshire’s investments may focus on the healthcare, Bitcoin, and technology sectors. However, client portfolios may also include a wide range of diversified holdings, including (but not limited to): other US and international equities, bonds, options, real estate equities, precious metal equites, Bitcoin infrastructure, digital securities, MLPs, and commodities.

Great Value with Low Hassle

Vailshire’s exceptional customer service is complemented by using Interactive Brokers, repeatedly rated the #1 online brokerage firm by Barron’s. Through Interactive Brokers, Vailshire manages the following account types:

- Individual and joint brokerage accounts

- Trust brokerage accounts

- Traditional IRAs

- Rollover IRAs

- Roth IRAs

Annual Management Fee for Separately Managed Accounts:

1%: For up to $1 million in total assets under management (AUM).

0.75%: For accounts with AUM between $1 million and $5 million.

0.5%: For accounts with AUM greater than $5 million.

Initial Investment:

$100,000 (minimum deposit) for SMAs and $1 million for Vailshire Partners, LP.

Note:

Clients need not be Accredited Investors to utilize Vailshire’s professional separately managed account (SMA) services.

Interactive Brokers Disclosure

Please click here for the Interactive Brokers LLC standard disclosure.